#8 - Frontier Tech Special Edition - VC Readings

Why your startup idea isn't big enough for some VCs, SPACs, the end of VC as we know it, Bessemer & price sensitivity, SPVs, crypto, David Marquardt, & the one ingredient required to get into venture

Frontier tech weekly will resume next week but I’ve realized I occasionally end up with readings I want to share that don’t quite fit the frontier tech scope, in which case I’ll do a special edition. My hope is that these posts about VC landscape/markets, history, and funding mechanics will be helpful to my investor friends, founder friends, and more — Let me know what you think!

Venture Landscape / Markets

SPACs: A Second Look at SPACs: Is This Time Different? (1.24.22)

“The structural elements of SPACs that are the source of their dilution and incentive misalignment remain essentially unchanged. Those elements are as follows:

The essentially free shares a sponsor takes as its “promote”

The free warrants issued to IPO investors

An underwriting fee that does not adjust for redemptions

Other high fees incurred at the time of the merger”

Venture Landscape: The End of Venture Capital as We Know It (8.4.21)

“All signs seem to indicate that by 2022, for the first time, nontraditional tech investors—including hedge funds, mutual funds and the like—will invest more in private tech companies than traditional Silicon Valley–style venture capitalists will.

And so a shift is afoot: “(VCs) can become just “capitalists” (drop the venture) and engage in direct and cutthroat competition with larger East Coast and global institutions to offer cheaper and cheaper capital. Or they can stick to their roots and move on from the increasingly tame world of software and internet investing to wild new horizons. (Think biotech, new parts of artificial intelligence and much more.)The choice, in a nutshell: Prepare to enter the bigger pond as a fairly small fish, or go find another small pond.”

“On the other hand, seed investing is somewhat insulated from the shifts occurring in the venture market because, brand-new startups lack the instrumentation and metrics needed for efficient scale. As a seed investor, you are still mostly betting on people and ideas—not metrics."

“If you are a young person working in and around the VC ecosystem, you have a big choice to make right now about how you want to spend your career. However, if you want to be a venture capitalist leading the next era, you should look for opportunities no one else is funding because they are too weird, too crazy or too small—at least today." (Shameless plug, the latter is very aligned with how we think about the world. If you’re interested in investing from this perspective, shoot anyone one our team a DM.)

Crypto Markets: What Goes Down Must Go Up? What we might get wrong when investing in equities, tokens, and liquid assets across multiple cycles by Mike Dempsey (8.30.22)

“Within crypto, markets have sold off across the board. This has led to a variety of managers discussing “generational buying opportunities” for liquid tokens that have seen 70-95%+ drawdowns. Managers are using this as an opportunity to try to accumulate capital, a narrative shift from 2021 liquid token fundraises2 that talked about how drastically undervalued these assets were as total crypto market cap was only ~$2T.”

“There is a major problem with this thinking: Crypto tokens have not been around long enough to take advantage of the Lindy Effect.

Put more directly, when public equities like META or AMZN sell off, there are material moats and business flywheels that are spinning that mean the amount of effort and change required in the world to kill or materially damage these businesses is quite high. That isn’t to say that apple ramping up privacy won’t kill Meta, or other competition or factors won’t decay large public company businesses, but there are fundamentals to these assets that take time to erode. In crypto, a market where the primitives of value creation and moats are still very obscure and non-consensus, erosion and death can happen with far less energy and innovation.”

Venture Figures & History

Venture Capital Greats: An Oral History of David F. Marquardt (2011-2012)

“Prior to August Capital, Dave was a co-founder of Technology Venture Investors (TVI) in 1980, where he was involved in four highly successful funds that invested in more than one-hundred start-up and emerging growth companies. Among these early investments was Microsoft, where TVI was the sole investor and where Dave has been on the board of directors since 1981.” The history also covers David’s time at Xerox (Diablo Systems), the Homebrew Computer Club, Memorex, and Sutter Hill Ventures with Bill Draper.

“Can someone learn to be a good venture capitalist? Is it a science or is it an art? DM: It’s interesting. I’ve been at it for thirty years now, and I thought I knew exactly what it took to be a great venture capitalist my third or second year into this career. And the longer, the more time I spend at it, the less certain I am that I could judge that. Because, if you think about it, you’ve met a lot of people and they’re all really different. I would say that the common themes are: most of them are really smart in one way or another, they’re relatively good at judging people, but boy, they come from all kinds of walks of life.”

Firms: The Anti-Portfolio: Bessemer Venture Partners is a thoughtful firm in a world of loose money (8.3.21)

“One former investor observed that if there was any real strike against the firm it was that the firm is “too smart for its own good.” Bessemer deconstructs markets, searches for needle in the haystack companies, & sometimes still gets outsold or outbid by a spendthrift rival."

VC Mechanics

Fund Economics: Why your startup idea isn’t big enough for some VCs by Mike Dempsey (3.22.17)

This post is from 5 years ago but still massively helpful. What is a “venture-scale business?” and how does it shift per individual fund economics? Mike breaks down the math VCs do on returning their fund.

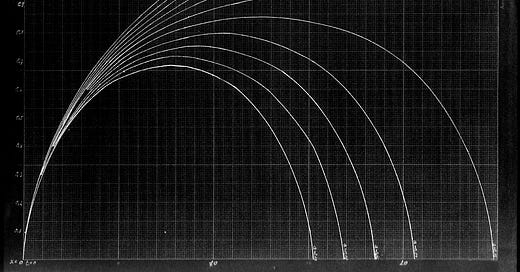

“Venture Capital functions with a power law where the majority of a fund’s returns come from a small percentage of investments. Because of this, VCs need to know if a single investment can return the entire fund. As Bill Gurley famously said “Venture capital is not even a home run business. It’s a grand slam business.”

“As a founder, this trickles down to thinking about their potential investor’s philosophy. While some businesses are best built to exit in the hundreds of millions of dollars, larger funds could push startups through their natural inflection/exit points in order to go for broke and hit a grand slam that is very unlikely to occur.”

SPVs & Fund Economics: SPV vs Venture Fund Economics by Erik de Stefanis (8.21.21)

If you see SPVs around often but don’t fully understand what an investment out of an SPV versus a fund might mean in terms of investor incentives and fund dynamics, this is a great post.

Interviewing in Venture: The One Ingredient Required to get into Venture Capital by Semil Shah (4.1.18)

“While there are 101 pathways into venture, to be effective and competitive one needs to have acquired sufficient “context” about the ecosystem they’re investing into before they saddle up with a venture firm.

Ok, so then, how would you define “context” in this context?

My belief is that in the VC game, having “context” means possessing the following: You have a network; you hold a point of view on a few topics that matter to you; that other people seek you out for help and advice; you have some understanding as to how the ecosystem’s participants — the founders, the early employees, the “joiners,” the operators, the angels, the investors, and the press — interact in the game. I believe if you show up in VC without these points of context, you won’t be as effective or be able to compete.”

I think the point about building “context” is also relevant for anyone who’s cross-industry job searching. For venture or otherwise, as I learned when switching between a few industries, being conversant in industry basics and deep in a few favorite topics will really go along way, especially if you’re trying to signal your ability to learn about a new category (which is often more important early in your career), rather than prove your experience.

Request for frontier tech help.

Looking to bounce around ideas about technology in the space? Looking for a cofounder or team member, or want to submit a job description to be featured in my newsletter? Trying to join a new frontier tech startup? Fill out the form below and let me know what’s on your mind. I’ll do my best do respond with an answer, suggestion, company, or meeting time!